(903) 622-9988

903-622-9988

God saw that the light was good, and he separated the light from the darkness.

-Genesis 1:4

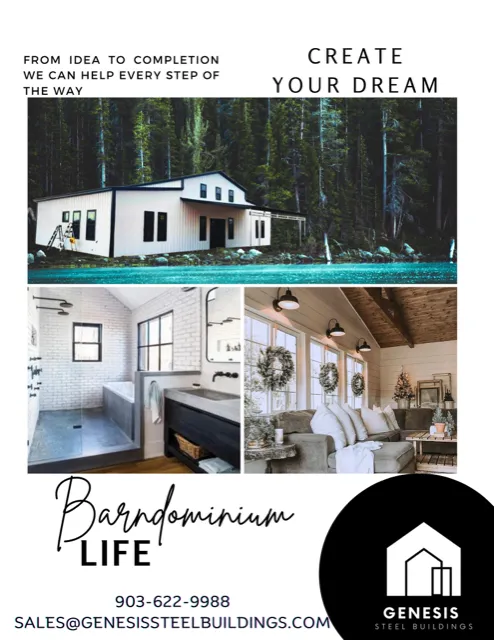

Genesis Steel Buildings

God saw that the light was good, and he separated the light from the darkness. Genesis 1:4

READY TO PURCHASE? CALL US 903-622-9988

Design your steel structure in minutes!

We guarantee the best price in the industry! You can have your building delivered and installed 3-4 weeks after deposit is placed!

Current lead times are 3-4 weeks after your deposit is paid!

Financing options available!

Give us the opportunity to earn your business.

WE BUILD AND INSTALL

TEXAS

OKLAHOMA

ARKANSAS

LOUISIANA

MISSISSIPPI

NEED MORE THAN JUST A BUILDING?

CALL US TODAY (903) 622-9988

Open Storage

Pull Through

Our steel structures are engineered to withstand 140mph winds and have a load rating of 35psf.

Concrete and taxes are not included in the advertised price. Concrete quotes can be provided upon request.

Empowering Rural Growth: Understanding USDA Building and Industry Loans

In the vast tapestry of America, rural communities serve as the backbone of our nation's economy. Yet, fostering growth and prosperity in these regions often requires targeted financial support. Enter the USDA Building and Industry Loan program—a vital resource designed to fuel economic development, job creation, and infrastructure improvement in rural America. Let's explore what these loans entail and how they're making a tangible difference in communities across the country.

What are USDA Building and Industry Loans?

The USDA Building and Industry Loan program, administered by the United States Department of Agriculture (USDA), is part of the broader suite of initiatives aimed at promoting rural development. These loans provide financing for projects that support business growth, job creation, and community infrastructure improvement in rural areas. Eligible borrowers include businesses, cooperatives, nonprofits, municipalities, and other entities operating in qualifying rural regions.

Key Features and Benefits:

Flexible Financing Options: USDA Building and Industry Loans offer flexible financing options tailored to the unique needs of rural businesses and communities.

Borrowers can use the funds for a variety of purposes, including:

Constructing, expanding, or renovating commercial and industrial buildings.

Purchasing equipment and machinery to support business operations.

Upgrading essential infrastructure, such as water and wastewater systems, energy efficiency improvements, and telecommunications networks.

Developing industrial parks and business incubators to attract investment and promote economic growth.

Favorable Terms and Interest Rates: One of the standout features of USDA Building and Industry Loans is the favorable terms and interest rates offered to eligible borrowers. These loans typically feature low fixed interest rates, extended repayment terms, and no prepayment penalties, making them an attractive financing option for rural businesses and communities. and they offer up to 90% financing for your Project.

Support for Job Creation and Economic Growth: By providing access to affordable financing, USDA Building and Industry Loans help stimulate economic activity in rural areas, creating jobs, expanding business opportunities, and strengthening local economies. Whether it's funding a new manufacturing facility, upgrading agricultural processing infrastructure, or revitalizing downtown commercial districts, these loans play a crucial role in driving sustainable growth and prosperity.

Focus on Rural Development: The USDA Building and Industry Loan program is specifically targeted at rural communities, where access to traditional financing options may be limited. By prioritizing projects that directly benefit rural areas, the program helps level the playing field and ensure that all communities have the resources they need to thrive.

Technical Assistance and Support: In addition to financing, USDA Rural Development provides technical assistance and support to help borrowers navigate the loan application process, develop project proposals, and implement their projects successfully. This hands-on guidance enhances the likelihood of project success and maximizes the impact of USDA Building and Industry Loans on rural communities.

Eligibility Requirements:

To qualify for USDA Building and Industry Loans, borrowers must meet certain eligibility criteria, including:

Operating in a rural area as defined by the USDA.

Demonstrating a viable business plan and financial feasibility for the proposed project.

Having the ability to repay the loan and provide sufficient collateral.

Complying with environmental and other regulatory requirements.

Conclusion:

In an era of rapid urbanization and economic globalization, it's more important than ever to invest in the vitality and resilience of rural communities. USDA Building and Industry Loans represent a powerful tool for driving rural development, empowering local businesses, and strengthening the fabric of rural America. By providing access to affordable financing, fostering job creation, and supporting critical infrastructure projects, these loans are helping to unlock the full potential of rural communities and ensure a brighter future for generations to come.

To apply for a USDA Business and Industry Loan, go to CTFfunding.com today.

Current Specials

Price does not include concrete or taxes, sales tax varies for each zip code! Concrete can be quoted in select areas!